Intergenerational Dilemma: Balancing Windfalls and Burdens of Public Transfers in Korea

Over the past few decades, the global demographic landscape has rapidly transformed with the onset of an unprecedented era of population aging. Among others, South Korea has emerged as the world’s fastest-aging country, exhibiting the lowest total fertility rates and the most rapid growth in the elderly population (Bloom et al., 2023). Despite this demographic shift, the nationwide development of old-age income security measures was introduced relatively late, in the early 2000s, in response to an elderly poverty rate exceeding 40% (Chung, 2024). To provide financial security to the ever-increasing elderly population, the Korean government introduced the Basic Pension (BP) system in 2008. This non-contributory pension unconditionally transfers cash to 70% of the population aged 65 or older, providing windfalls for the elderly, while funding is sourced from shrinking younger generations.

The adult children of financially insecure elderly parents may face particularly constrained economic decisions across various life-cycle stages, as they may have to bear the dual responsibility of increasing BP funding burdens and providing financial support to their financially insecure parents. If BP benefits completely crowd out financial support from adult children, the burden on the children will be eased, but the elderly parents will have no windfall gains (Becker, 1974). However, if the benefits only partially crowd out financial support from adult children, the parents will experience windfall gains while the adult children remain burdened with continuing to provide both public and familial financial support for their parents (Cox et al., 2004).

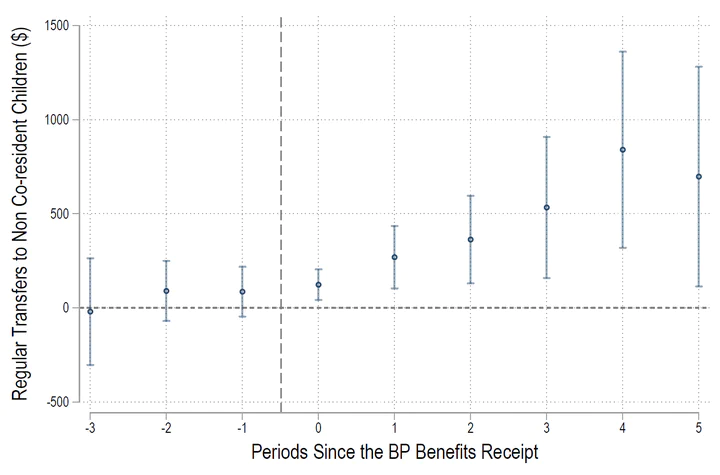

How should we achieve an intergenerational balance between the windfalls that benefit the elderly and the burdens that affect their children? While existing studies mainly focus on potential crowding-out effects for policy evaluations (Nikolov and Bonci, 2020), the literature is silent on “how recipients utilize the benefits they receive.” For example, if windfall gains of elderly parents are shared with their children, both parents’ and children’s net gains may vary. In this paper, I present new evidence on the importance of the impact of recipients’ shared benefits, which I term the spillover effect, alongside the crowding-out effect to understand net gains from public and family transfers in Korea, crucial for balancing windfalls and burdens in intergenerational public and household finances.

I find evidence that BP benefits displaced the transfer burdens of adult children for elderly single households and resulted in net gains for both family members and recipients in elderly couple households living without children. However, elderly couples living with their children experienced net gains, with the wealth of their children being redistributed from non-coresident to coresident children. The findings suggest that considering how recipients utilized their benefits can alter policy evaluations, contrasting with current literature.